What Are Carbon Credits?

Carbon credits, often referred to as carbon offsets, are a way to measure and mitigate greenhouse gas emissions. They represent a unit of reduction, removal, or avoidance of one metric ton of carbon dioxide (CO2) or its equivalent in other greenhouse gases. These credits are typically associated with specific projects or activities that reduce emissions or enhance carbon sequestration (removing CO2 from the atmosphere).

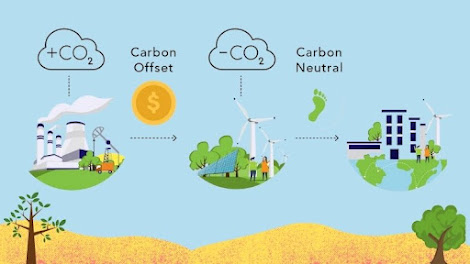

How Carbon Credits Work

The fundamental idea behind carbon credits is to provide an economic incentive for entities, such as businesses or governments, to reduce their greenhouse gas emissions. Here's how it works:

Emission Reduction Projects: Organizations or individuals initiate emission reduction projects. These projects can take various forms, including renewable energy installations, reforestation efforts, energy efficiency improvements, and methane capture at landfills.

Measurement and Verification: Independent third-party auditors assess and verify the emissions reductions achieved by these projects. This verification process ensures that the reductions are real, additional (beyond business-as-usual), and permanent.

Issuance of Carbon Credits: Upon successful verification, carbon credits are issued in accordance with the emissions reductions achieved. Each credit represents one metric ton of CO2 equivalent that has been either reduced or removed from the atmosphere.

Trading and Transactions: Carbon credits can be traded on carbon markets. Buyers, such as companies seeking to offset their own emissions or meet sustainability goals, purchase these credits. The revenue generated from selling carbon credits can help fund ongoing emission reduction projects.

Retirement or Use: Once purchased, the carbon credits can be retired, effectively taking them out of circulation and ensuring that the emissions reduction is not double-counted. Alternatively, they can be used to offset an organization's own emissions, thus achieving carbon neutrality.

Types of Carbon Credits

There are two primary types of carbon credits:

Compliance Credits: These credits are typically associated with regulatory compliance. Governments or regulatory bodies may set emissions reduction targets for certain industries or sectors. Entities subject to these regulations can use compliance credits to meet their obligations.

Voluntary Credits: Voluntary carbon credits are not tied to regulatory requirements but are used by organizations and individuals voluntarily to offset their carbon footprint. Many companies and individuals purchase voluntary credits as part of their commitment to sustainability and corporate social responsibility.

Benefits and Significance

Carbon credits offer several key benefits and play a significant role in addressing climate change:

Emissions Reduction: Carbon credits incentivize emissions reduction activities that might not otherwise be financially viable. This leads to tangible reductions in greenhouse gas emissions.

Financial Incentives: They provide a source of revenue for emission reduction projects, making clean energy and sustainability initiatives financially viable for project developers.

Global Collaboration: Carbon credits facilitate international cooperation in the fight against climate change. They allow entities in one part of the world to support emissions reductions in another, promoting global climate action.

Carbon Neutrality: For businesses and individuals, carbon credits offer a pathway to achieve carbon neutrality by offsetting their own emissions through the support of emissions reduction projects elsewhere.

Market-Based Approach: The carbon credit market operates on a supply-and-demand basis, which encourages innovation and cost-effective emissions reduction strategies.

Challenges and Concerns

While carbon credits are a valuable tool in the fight against climate change, they are not without challenges and concerns:

Additionality: Ensuring that emissions reductions are truly additional to what would have occurred without the carbon credit funding can be challenging.

Verification: The verification of emissions reductions can be complex and costly, requiring robust monitoring and reporting mechanisms.

Transparency: Critics argue that some carbon credit projects lack transparency, making it difficult to assess their environmental integrity.

Market Volatility: Carbon credit prices can be subject to market fluctuations, which can impact the financial viability of emission reduction projects.

Limited Scope: The carbon credit market primarily focuses on CO2 emissions, but other greenhouse gases, such as methane and nitrous oxide, also contribute to climate change.

Conclusion

Carbon credits are a critical tool in the global effort to combat climate change. They provide a framework for incentivizing emissions reduction projects, fostering international collaboration, and enabling individuals and organizations to take meaningful steps toward carbon neutrality. While challenges and concerns exist, the carbon credit market continues to evolve and play a crucial role in mitigating the impact of human activities on the environment. As the world collectively strives to address the climate crisis, carbon credits remain a valuable resource in our arsenal of climate solutions.

Comments

Post a Comment